National Pension Scheme (NPS)

National Pension Scheme (NPS) is one of the most underrated investment instruments available in India and is ignored by most of the people because of the strict withdrawal rules. In this article I’ll tell you the benefits of NPS and why you should start investing in it, if you are not already doing it.

What is National Pension Scheme?

NPS is a retirement scheme offered by the Government to provide security and regular income to the citizen after retirement. This is a scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA), and can provide a decent return over long term. It was started by the Government in 2004 exclusively for the government employees, and was extended to all other citizen of India in 2009. Any citizen of India between the age of 18-65 years can invest and take benefits of NPS. On enrolling to NPS, you get a unique PRAN (Permanent Retirement Account Number), which will be same throughout your life.

Benefits of investing in National Pension Scheme

When you invest in NPS, you get the following benefits:

- Flexibility: You get the flexibility to select the fund manager, investment asset class, and the percentage of contribution to all the asset types you select. If you are not satisfied with the fund manager’s performance, you can change it anytime.

- Security after Retirement: Post retirement, you get some amount of your portfolio value as a lump sum amount. Apart from this, you need to invest the remaining amount in annuities which ensure regular monthly income post retirement.

- Returns: History has proven that Equity has performed much better than any other asset class over long term. Since NPS offers a part of the investment to be exposed to Equity, the overall return in NPS is significantly higher than many other fixed investment options like Fixed Deposits, Provident Funds, etc. You can expect an annual compounded growth of approx. 9-10% on the invested amount (much more than this actually since you get tax benefits too, which is explained later in this page) if you properly allocate your investments. I’ve explained the asset allocation in NPS below.

- Risk: Since NPS has an upper cap on the high risk Equity, this makes it mandatory to invest a significant portion (at least 25%) of the investment amount to be allocated to other moderate and low risk options. This makes it a relatively safe instrument than Equity or Equity based Mutual Funds.

- Tax Benefits: You get tax benefits when you invest in NPS. It is an EEE (Exempt-Exempt-Exempt) type investment. It means you can save taxes on the invested amount, the capital gain, and the withdrawal.

Asset classes in National Pension Scheme

The amount invested in NPS can be allocated to the following asset classes:

- Equity (E): This class invests in Equity market instruments (shares on listed companies)

- Corporate Debt (C): This class invests mostly in the Bonds (and other fixed income instruments) issued by corporate bodies such as PSUs and various Infrastructure companies.

- Government Securities (G): These are the securities offered by various central and state government.

- Alternative Investment Funds (A): This category consists of instruments such as CMPS (Commercial Mortgage-backed securities), Real Estate Investment Trusts (REITs) etc. I’ll explain these instruments in other post soon.

Each of these asset classes are different in terms of different risks and rewards. Please refer to the below table.

Investment choice for National Pension Scheme

Active choice

If you decide to invest in National Pension Scheme, you get the flexibility to decide the allocation of your funds. It means you get to decide what percentage of your invested amount goes to which asset class (mentioned above): E, C, G and A. However, some of these asset classes have upper cap on the percentage allocated to them.

- For class (C) and (G), you can allocate 100% of your investment

- For class (A), you can invest up to 5% of your investment

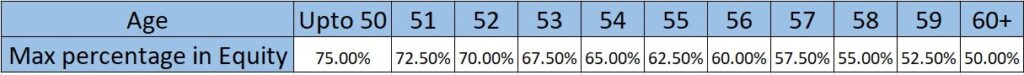

- For Class (E): Since equity has high risk, as your age grows, the maximum permissible percentage to be invested decreases according to the table below

Auto choice

If you don’t want to manage your allocation by yourself, you get another option of Auto-choice too. If you select this option, and provide your, the allocation to different asset classes is decided based on your age and your investment profile (Aggressive, Conservative or moderate) provided by you

- Aggressive: In this profile, the maximum exposure to equity is 75%.

- Moderate: In this profile, the maximum exposure to Equity is 50%.

- Conservative: This is the lowest risk option available in Auto-choice. The maximum percentage which can be allotted to equity is 25%.

In each of these profiles, with growing age, the allocation to equity decreases and the exposure to Government securities increases.

Models of investment in National Pension Scheme

Corporate

You can invest in the National Pension Scheme directly through your employer as a deduction from your payroll. You’ll have to provide your PRAN to your employer and link your NPS account to your employer’s POP-SP (Point of Presence Service Provider), who acts as a collection point for your investment and helps with the investment. A maximum of 10% of your basic salary can be invested in NPS. This amount would be deducted from your gross salary and thus, there is no tax liability on this.

For instance, if your monthly basic salary is Rs 50,000 then you can invest a maximum amount of Rs 5,000 in NPS per month directly through your employer.

Individual

For entrepreneurs and business people, there is no fixed salary, and thus they cannot invest in National Pension Scheme using the Corporate model. They however, can do direct contribution through their POP-SP or directly through the NPS website. The salaried people can also utilize this way of investing in NPS. A tax exemption on an investment of up to Rs 50,000 can be availed on individual contribution to NPS under Section 80CCD (1B).

As a salaried employee, you can invest using both the models: Corporate as well as Individual and maximize your tax benefits.

NPS Withdrawal?

Under normal conditions, you can withdraw your money from your NPS account when you attain the age of 60 (called superannuation age). However, not all the amount can be withdrawn by you and used directly. You can withdraw a maximum amount equal to 60% of the total value, and the remaining amount must be used to purchase an annuity (regular income plan) from IRDA (Insurance Regulatory and Development Authority) regulated insurance companies.

Note: If the total portfolio value at the time of superannuation is less than Rs 2,00,000, then the total amount can be withdrawn as a lump sum amount.

You can withdraw from your NPS account before superannuation. However, pre mature withdrawal has some conditions which need to be met:

- Your NPS account must be at least 3 years old.

- You cannot withdraw more than 25% of your total contributions made till the time of withdrawal.

Note: If the portfolio value is less than Rs 1,00,000, then you can withdraw the complete amount and exit from NPS. However, to exit, the account should be at least 10 years old.

- You can do pre mature withdrawal only 3 times before superannuation.

- Only specific reasons are allowed for pre-mature withdrawal, like higher education of children, marriage of children, treatment of some critical illness, purchase or construction of resident property etc.

Tax on NPS withdrawal

The complete amount which you withdraw as lump sum and the amount which you use to purchase annuity, both are tax free. However, the monthly income which you receive as a part of the annuity plan is taxable as your normal tax slab for that year.

An Example for Investing in NPS

Suppose A is of age 25 and has a basic salary of Rs 10,00,000 currently (30% tax slab). He wants to minimise his taxes, and invests in National Pension Scheme using both the modes: Corporate as well as individual. Since maximum tax free investment allowed for individual contribution is Rs 50,000, he invests only this much as a part of individual contribution. He regularly contributes to NPS and continues to do so till superannuation age, i.e. 60. His total contribution in a year will be

Rs 1,00,000 (corporate) + Rs 50,000 (individual) = Rs 1,50,000

To keep the calculations simple, let us say he invests this amount monthly which makes his monthly contribution to Rs 8,333.33 (corporate, 1L / 12) and Rs 4166.66 (individual, 50K / 12) respectively. Considering a moderate hike of 5% in salary per year, his corporate contribution will also increase by 5% per year and the individual contribution will stay fixed at Rs 4166.66 per month.

Historically, NPS has given an average annual return of 10-11%. For this example, let us keep the return a little extra conservative, say 8.5%.

Going by the compound interest formula, an amount of Rs 12,500 (with amount increasing by 5% per year, only for two-third of the initial monthly investment), compounded monthly for 35 years (60 – current age) at an annual rate of 8.5%, sums up to a massive amount of Rs 4.9 CRORES.

Let us see the total amount A invested, which comes close to 1.08 crores. Oh wait!!! There is more…….

If A had not invested the amount in NPS, then he’d have to pay a tax of 31.2% (30% + 4% cess) on the invested amount. So, we can say that effectively he invested a total amount of only Rs 74L over the period of 35 years.

Now coming to withdrawal. Out of the 4.9 crores, he can withdraw a lump sum amount of close to Rs 3 crores (60%), which will completely be tax free. He will have to invest the remaining Rs 1.9 crores to purchase an annuity plan which will provide him a monthly income for life.

Should you invest in NPS?

Seeing the benefits of NPS, I’d suggest you to maximize their investment into National Pension Scheme at least till the amount on which you can save tax, with allocating maximum percentage to equity. The general issue because of which people don’t prefer NPS is that they don’t want to wait till age 60 to be able to withdraw their money. Yes, I agree but see it this way, If you are in the 30% tax slab and investing Rs 50k in NPS, you’d not actually be locking your 50K, you’d actually be locking only Rs 34.4K because if not, you’d lose those Rs 15.6k in taxes (+ cess) anyways.

Given the decent returns and less risk of NPS, we can say that this is an excellent investment if you are planning for retirement.

How to invest in NPS?

For individual contribution, you’ll have to register on the NSDL website. On successful registration, a PRAN number will be allotted to you and a physical copy of the PRAN card will be sent to your registered address. Post registration, you can start contributing to NPS on logging into the same website.

For corporate contribution, you can follow the above, provide your PRAN number to your employer and change your POP-SP to your employer’s POP-SP.

Please let me know if you have any queries regarding NPS using the comment section below or the Contact Me page of the website.