All about Provident Funds – EPF, PPF and VPF

Planning for retirement is one of the most important things in life. With proper retirement planning, one can live a comfortable and financially secure life after retiring. One must ensure sources of income during retirement and this should begin the day one starts earning. After all, everyone wants to kick back and relax during retirement and not worry about mundane things.

There are various ways one can start saving and investing for retirement. One can invest in Stocks, mutual funds, real estate, business, fixed deposits etc. Not everyone has the risk appetite for investing in market dependent instruments. For people with low risk appetite and seeking guaranteed returns, Provident fund is one of the best investments to fund their retirement. I have often seen friends getting confused between Employee Provident Fund (EPF), Voluntary Provident Fund (VPF) and Public Provident Fund (PPF). I’ll explain everything about these in this post: investing, returns, withdrawal and taxation. To quote Zakir khan, “Bhai aaya hai, bata ke jaega” 😉.

Let us start with Employee Provident Fund (EPF).

Employee Provident Fund (EPF)

This is for organisations registered in Employee Provident Fund Organisation (EPFO). Any organisation with more than 20 salaried employees are mandated to register with EPFO. On switching employers, one can get their EPF account mapped to the new employer by submitting Form 11 and continue to get EPF benefits.

Contribution

In EPF the employee contributes 12% (10% in some cases) of his Basic + Dearness allowance to the EPF account. The employer is also required to match the amount and contribute to employee’s EPF account. The interest on EPF is calculated monthly and is deposited to the employee’s EPF account after the end of the Financial year.

Interest Rate

EPF interest rate for the last financial year (2019-20) was 8.5% per year.

Withdrawal

EPF can be withdrawn 100% in the following conditions:

- When an individual retires.

- When the individual is unemployed for more than 2 months.

Once an employee reaches 54 years of age, he can withdraw up to 90% of the EPF balance at that time. Apart from this, partial withdrawal of the EPF balance is also allowed in certain exceptional scenarios like

- Medical purposes

- Purchase of house/repayment of home loan

- Marriage of self/siblings/children.

- Self/Children’s education

- Home renovation

Tax

The employee contribution to EPF comes under Section 80C and is tax exempt up to the limit of 80C (current limit: 1.5L per year). The employer contribution to EPF is not a part of the employee’s Gross salary and thus, has no tax liability. There is no tax liability on the total amount accumulated in your EPF on withdrawal at retirement. In case of withdrawal before completion of 5 years of service, EPF amount is considered as taxable income for the year of withdrawal and is taxed as per the tax slab of the individual.

You can check your EPF balance, see the passbook or initiate a withdrawal on the EPFO website.

Voluntary Provident Fund (VPF)

Voluntary Provident Fund is a ‘voluntary top-up’ over the Employee Provident Fund. It allows an employee to contribute more than 12% to his EPF account if wanted. However, the employer is not required to match the VPF contribution done by the employee.

Contribution

You can contribute an amount of up to 100% of Basic + Dearness allowance as a voluntary investment in VPF.

Interest Rate

Interest rate in VPF is the same as that of EPF.

Withdrawal

The withdrawal rules for VPF are the same as EPF

Tax

Contribution to VPF comes under section 80C and is tax exempt up to the limit of 80C (current limit: 1.5L per year). In case of withdrawal after 5 years of service, there is no tax liability. If the withdrawal happens before 5 years of service, the amount will be taxable as per your income slab.

Public Provident Fund (PPF)

Public Provident Fund was introduced in India in 1968 as an alternative to Employee Provident Fund which enabled those with non-salary income to invest and save for retirement while saving tax. PPF is a long term investment which offers a decent guaranteed return. You can invest in PPF by opening a PPF account with any of the nationalized or authorized private banks.

Contribution

You can contribute any amount between Rs 500 to 1.5L in a financial year in PPF.

Interest Rate

The interest rate in PPF account varies quarterly. The current interest rate is 7.1% per year (July 2020-Sept 2020). The interest is calculated monthly, on the minimum balance between the fifth and the last day of the month. Hence, to make the maximum out of your PPF account, you should invest in PPF before 5th of the month.

Withdrawal

PPF account gets matured after 15 years. On maturity you have the option to withdraw the complete amount or extend the account to another 5 years without making any contribution.

Full withdrawal is allowed after the 5th year. However, one can withdraw partial amount once a year. The maximum limit for partial amount withdrawn is smaller of:

- 50% of the balance in the PPF account at the end of the 4th year

- 50% of the balance in the PPF account at the end of the year preceding the year in which the withdrawal is to be made.

Tax

Contribution to PPF comes under Section 80C and is tax exempt up to the limit of 80C (current limit: 1.5L per year). On withdrawal, the entire amount is tax free.

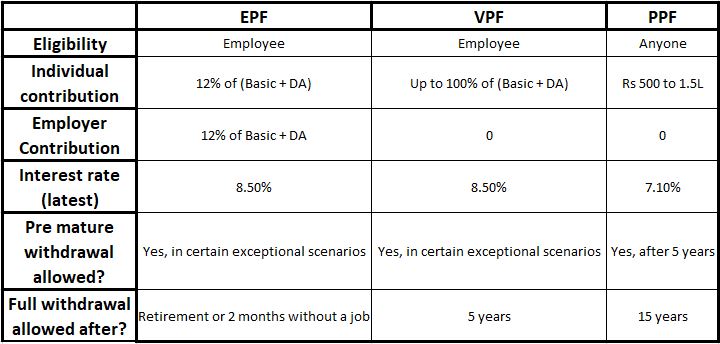

Comparison

Which is the best to invest?

All the above types of Provident funds are safe form of investments with a guaranteed return which makes them attractive modes of investments. If you are salaried and your organisation has more than 20 employees, then you must already be contributing to EPF. If you wish to invest extra amount towards your retirement goals and want a safe return you can elect VPF. Since the interest rate is much higher than that in PPF, the difference can be considerable in long term.

An Example

Dumbledore and he-who-must-not-be-named are two 25-year-old employees in the same organisation with equal salaries. They both get equal amount of EPF benefit.

They both have around Rs 10,000 surplus after their expenses every month and wish to invest in some risk-free investment with decent guaranteed returns to secure their retirement. He-who-must-not-be-named invests that amount in PPF every month. Dumbledore, being the smarter one invests his 10,000 in VPF through his employer.

Assuming the rate of interest remains same as the current rate for both PPF and VPF, the amount of fund they would have accumulated at the end of 35 years (age 60) will be:

He-who-must-not-be-named: Rs 10k contribution per month for 35 years at 7.1% interest

= Rs 1,16,94,526

Almost 1.17 Crores

Dumbledore: Rs 10k contribution per month for 35 years at 8.5% interest

= Rs 1,70,21,130

Almost 1.70 Crores

So, one can see clearly that difference of just 1.4% in the interest rate creates a difference of massive 53L over a period of 35 years. This is the power of compounding, which was called as the 8th wonder of the world by Albert Einstein. I’ll cover the topic of compounding and how we can maximize its benefits in a future article soon.

Go ahead and pull up your salary slip to find out how much you are saving for your retirement!

Did you like the article or have any questions related to the article? Let me know in the comments below. If you have any doubts or questions regarding the article or any other topic in the website, you can reach out to me through the Contact Me section of the website.