Salary and Tax Calculation

Paying too much income tax, but confused how to save taxes? Don’t worry, I’ll tell all the methods by which you can save on income tax. Before that, lets see how your salary and tax calculation is done.

Income tax is calculated on the total income you earn during the financial year, including:

- Income from salary.

- Income from other sources (Bank FD, interests, lottery etc).

- Income from property.

- Income from capital gain (gains from selling assets like stocks, mutual funds, property etc).

- For self-employed people, there is no salary. Their income falls under income from Business and profession.

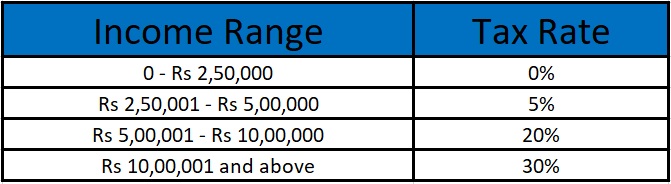

Most of these income categories are taxed based on a tax slab, given below. However, capital gains are not taxed as per the tax slab. I’ll explain the tax calculation for capital gains later. For now, lets see the existing tax slabs in India:

Tax on the first 2.5L of the taxable income will be calculated at the rate of 5%. Tax on the next 5L income will be calculated at the rate of 5% and so on.

For example, if someone’s total taxable income is Rs 8,00,000, then his tax amount will be calculated like below:

Tax on first 2,50,000 = 0

Tax on next 2,50,000 = 5% of Rs 2,50,000 = Rs 12,500

Tax on next 3,00,000 (since only Rs 3L is remaining for this slab) = 20% of Rs 3,00,000 = Rs 60,000

Total Tax = 0 + Rs 12,500 + Rs 60,000 = Rs 72,500.

Now, the question is, how to calculate the taxable income? Taxable income is calculated by subtracting the total deductions and exemptions from the total income. You can check the instruments which you can claim for tax deductions here.

Let us understand the tax calculation with an example.

Suppose there is an individual A, living in a rented house in a Delhi and paying a rent = Rs 25000 per month. A has also purchased a house in his home town, which costed him Rs 40,00,000, for which he took a loan of Rs 30,00,000 (assuming contribution towards principal = Rs 1,00,000, contribution towards interest = Rs 2,00,000). A invests Rs 1L in ELSS Mutual Funds, and 1L in PPF every year.

The income details of A are given below:

Total income for A for the financial year = Rs 21,15,000 (income from Salary and bonuses + income from other sources + income from savings account interest – Employer share to Provident Fund)

Even if A is paying monthly House rent of Rs 25,000, not all of this amount will be eligible for deduction. The eligible amount will be the minimum of following:

- HRA Received (50% of basic salary for most of the companies) = Rs 5,00,000

- 50% of basic (Since A is living in a metro city) = Rs 5,00,000

- Rent paid – 10% of basic = Rs 25,000 * 12 – Rs 1,00,000 = Rs 2,00,000.

As we can see, the minimum of these is Rs 2,00,000. So, A will be able to claim an amount of Rs 2,00,000 as as HRA deduction.

The total income which can be removed from his taxable income = Investments under 80C (Maximum amount: Rs 1,50,000) + Home loan interest (Section 24) + HRA deduction + Deduction on Interest from Savings account (Maximum amount: Rs 10,000) + Standard Deduction (Rs 50,000)

= Rs 1,50,000 + Rs 2,00,000 + 2,00,000 + Rs 10,000 + Rs 50,000 = Rs 6,10,000.

So, the total taxable income for A = Total income – Exempt income

= Rs 21,15,000 – Rs 6,10,000 = Rs 15,05,000

A’s total tax will be calculated on the total taxable income of Rs 15,05,000.

In the budget of 2020, a new and optional tax slab with reduced tax rates has been introduced (given below). However, if you opt for the new tax slab, you’d have to give up all your deductions. So, if you do any investments, the old slab is probably much better for you as compared to the new one.

If you are a salaried employee, You can use the Salary Calculator to estimate your monthly net take home salary and tax amount based on your salary details and how much you invest. You can also compare the Old regime and New regime of tax calculations and select the best one for you.

Please let me know through Contact Me section of the website or through the below comments if you have any queries related to this article.