All about investing in peer to peer (P2P) loans

Well, many of us might have heard about the new ‘thing’ in the market called P2P lending or Peer-to-peer lending.You may have dozen questions about it like is it legal? how safe is it? how good it is for investing? how are the returns? and many more. This article will tell everything about P2P lending from an investor point of view. I will share my experience with P2P lending and why I think P2P lending qualifies to be a part of your portfolio

What is Peer to Peer Lending?

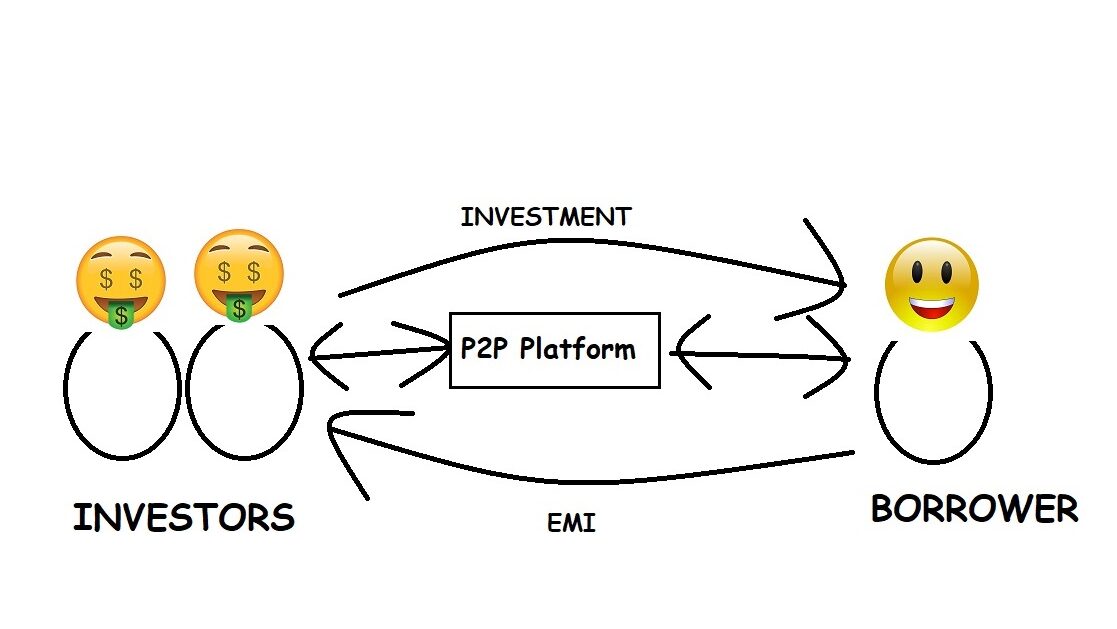

P2P lending is a way by which a business or an individual, can lend money to anyone who needs a loan.

In traditional loans, any borrower seeking a loan contacts a bank. After verifying his details and credit record, the bank approves or declines his application.

P2P loans are unsecured personal loans in which the borrower instead of reaching out to the bank, reaches out to other individuals/companies, called lenders. These lenders lend money to the borrower and the borrower has to return the money in EMIs with a pre-determined interest rate (similar to a bank loan).

Is P2P lending legal?

Yes, it is legal and was regulated by the Reserve Bank of India in October, 2017. The platforms forpeer to peer lending need to have “NBFC-P2P” certified to be able to match borrowers and lenders. However, there are certain rules as to who can invest in P2P loans:

- Investor should be an Indian resident.

- Investor should be more than 18 years.

- Investor should have a valid bank account in India.

- Investor should have a PAN card.

- The maximum amount which an investor can keep invested in P2P loans across all platforms at a given time is Rs 50L.

Why would anyone take a loan from individuals and not banks?

The borrowers of Peer to peer loans are individuals who cannot opt for bank loans because of different factors. A question which comes to many people is that why would the borrowers not go for bank loans and prefer loans from someone else? There are various reasons behind this:

- Credit score: Banks generally stay away from people who have bad credit score and do not approve their loans easily.

- Processing fees on bank loans: Some banks charge processing fees even for short term personal loans which can be large compared to the loan amount and interest.

- Less documentation and fast processing: The amount of documentation needed for bank loans can be huge for some cases. Also, the processing time in P2P loans is less compared to some banks.

How a Peer to peer loan works?

- Borrowers and lenders both register on the P2P lending platform by providing required documentation. Thorough checking is done for the borrowers, like fraud check, credit history checks, income proof check and physical verification.

- The borrower posts his income details, loan requirement details and other details on the platform.

- The lending platform verifies the details and if everything is legit, it approves the listing.

- Lenders see this loan along with the various other active listings on the platform.

- Lenders screens the borrower’s profile. If they find the profile matching to their risk criteria they invest in the loan.

- When the total amount invested by multiple borrowers becomes the loan requirement amount, the platform creates a loan agreement with the borrower on your behalf and the loan amount is disbursed to the borrower. This agreement mentions the interest rate offered, tenure of the loan, EMI and late charges, if any.

- After that, the borrower repays the loan in EMIs along with the interest amount. This amount received is divided and paid back to all the lenders who had invested in the loan. The amount paid to each investor depends on what was the ratio of his/her investment in the loan.

- This amount stays in an Escrow account created by the platform exclusively for each lender. The lender can choose to withdraw the amount or can invest the amount in other loans.

- Once all the EMIs are paid, the loan is marked as closed.

- If there are delays in repayment by the borrower, the loan is marked as delayed or default or NPA (non-profitable asset) depending on how much is the delay. In case of delay, most of the platforms have dedicated recovery teams which follows up with the borrower on a regular basis for the repayment.

What are the benefits and downsides of P2P lending?

Benefits

- High returns: You can earn up to 30% returns per annum if you invest smartly.

- Start with little amounts: Some platforms allow investments with amounts as low as Rs 500.

- Flexible tenure: You can invest for short term, ranging from 1 month to 3 years.

- Transparency: On most of the P2P lending platforms, you get to select the loan in which you want to invest, based on the borrower’s details.

- Monthly cash flow: You get monthly income in the form of EMIs.

Downsides

- High risk: Since the borrowers can be people with low credit scores, there is a high risk of loan defaults.

- Liquidity: If you have invested in a loan for suppose 3 years, you cannot get back that amount earlier if you need it urgently. Some platforms let you take out money earlier but they charge a penalty for the same.

Tax on P2P income

The interest earned by P2P lending falls under ’Income from other sources’ and will be taxed as per the tax slab of the investor. A negative point here is that in case a borrower defaults on his loan, even if there is a principle loss suffered by the investor, he cannot claim any tax benefits on the lost amount.

Platforms for investing in P2P Loans in India

There are various Peer to peer Lending platforms in India. I have accounts with 3 of them:

- I2IFunding: I started with P2P Lending on I2IFunding, and later switched to other platforms. Once you create a lender account on I2iFunding and verify your account by uploading the documents, you can check the available borrowers’ details and invest in any loan which you find promising. I2IFunding has following categories of loans available, depending on the risk profile of the borrower.

A loan with a good borrower profile has less interest rate. But the chances of the borrower repaying his EMIs timely is more, thus reducing the risk of the lender.

Registration fee: Rs 500 (18% GST)

Commission: 1% on the amount invested (No charges on the first Rs 50,000 invested)

Minimum amount per borrower: Rs 1,000

You can use this link to register as a lender on I2IFunding and get 50% off on the registration fees.

- Finzy: Finzy has option to choose borrowers by ourselves or put everything in auto invest mode. In auto invest, they invest your money automatically in the listed available loans. They don’t have any registration fees, but to start with the investment, they require a minimum first-time deposit amount of Rs 50K. This is a huge drawback since you cannot ‘try’ with smaller amounts before investing large amounts.

Registration fee: 0

Commission: 1% on the amount you get back from the investor. So, unlike I2IFunding, you don’t pay any commission if the borrower defaults on a loan.

Minimum amount per borrower: Rs 5,000

You can register on Finzy and start investing here.

- LendenClub: This is my favourite platform for P2P lending and I have been using it for more than 1 year now. When you register on LendenClub, a relationship manager is assigned to you who helps with any queries related to the platform or with investing. They offer various loan products, starting from ultra-short-term loans with tenure of 1 month to long term loans up to 2 years, have various categories of loans, low risk loans to Ultra high risk loans. Also, they charge the commission on only the interest you earn from the borrower, and not on the money invested, so this makes LendenClub cheaper than the other platforms. You can either choose to invest in loans manually or go through the option of auto investing. Their UI and mobile app is clean and simple.

Registration charges: Rs 500 (+18% GST)

Commission:

– 1.5% on the loans with interest rate up to 14%

– 2% on the loans with interest rate up to 14.01%-19.99%

– 3% on the loans with interest rate more than 20%.

For example, if the rate of interest rate in a loan is 30%, you get 27% and the rest 3% goes to the platform as commission.

Minimum amount per borrower: Rs 500

Register as a lender on LendenClub using this link and get Rs 50 discount on the registration fee.

Tips to invest in P2P lending and selecting borrower profiles

- Diversify: This is the most important factor to keep in mind while investing in P2P loans. If you want to invest Rs 10,000 and you invest all in a single loan and if the borrower defaults you will lose your entire investment. But, if you invest Rs 500 in 20 different loans and even if 10% of the borrowers default, you will lose only Rs 1000.

- Check the Risk category of the loan: Nearly all the platforms categorize the loans depending on the risk they carry. Understand your risk appetite and select the category which is more suitable for you.

- Check Borrower profile properly before lending: The P2P lending platforms provide the borrower details along with each loan listing. The most important details I see while deciding on a loan are:

- CIBIL score of the borrower: The higher, the better.

- Job and Income/Asset details of the borrower: Borrower with a stable job and salary is more likely to repay compared with a new or unstable business. However, that does not mean that the salaried person will definitely repay the loan on time and the businessman will default on the loan.

- Existing loans, EMIs of the borrower and the EMI to income ratio: Borrowers with too many ongoing loans or too many existing EMIs, with a large proportion of his monthly salary going as EMIs will have difficulty repaying back an extra EMI. Someone who has a salary of Rs 20,000 per month and ongoing EMIs totalling something like 12,000 will face problems with money if an additional EMI of Rs 3,000 is added to his debt. So, try to stay away from such borrowers.

- Purpose of the loan: If the purpose does not seem like a proper reason for borrowing or is unclear to you, is is better to just stay away from that loan.

- Previous defaults of the borrower: If the borrower has defaulted on loans in the past, stay away from that borrower.

- Repayment history: If the borrower has repaid his loans in the past, he/she seems like a good borrower and can be a good profile.

- CIBIL score of the borrower: The higher, the better.

- Re-invest: This applies to all the investment types, not just P2P lending. Once you get the principle and interest back from the borrower, instead of talking out the money and spending it, reinvest it in other loans. This way you’d actually be able to take the benefit of compounding.

My experience with P2P Lending

I started with peer to peer lending as an experiment with just a little amount to know about it and to get hands on with the experience. I contributed a small amount each month expecting not to get anything from it in return. For 6 months I kept doing this process and after 6 months, out of the 51 different loans in which I had invested, 5 defaulted. The return I got after 6 months of investing was decent, if not too high.

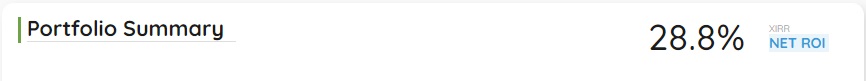

After 6 months, I analysed my strategy and took a slightly different approach towards selecting the loan profiles for investing. As of May 16th 2020, I have invested in 108 different loan profiles with a net Return on Investment of 28.8%.

Note: If we calculate the compounded rate, it’ll be even more because the investment was done monthly, and not all at the beginning. Pretty decent, isn’t it?

Also, out of these 108 loans, the total number of loans which got defaulted is only 6 which means that after I changed my strategy, out of 57 loans only 1 got defaulted. Out of these 6 defaulted loans, some borrowers defaulted on 1/2 EMIs, while some defaulted on the complete borrowed amount. Some loan repayments got delayed by 1 or 2 months but eventually they were repaid with interest and penalty. So, it has worked pretty good for me so far. Attaching screenshot of the returns from my LendenClub profile. 🤑🤑

So this was everything you need to start investing in p2p loans according to me. Please let me know if you have any queries regarding Peer to peer lending using the comment section below or the Contact Me page of the website.

Stay Happy, keep investing!!