Understand your Salary Slip

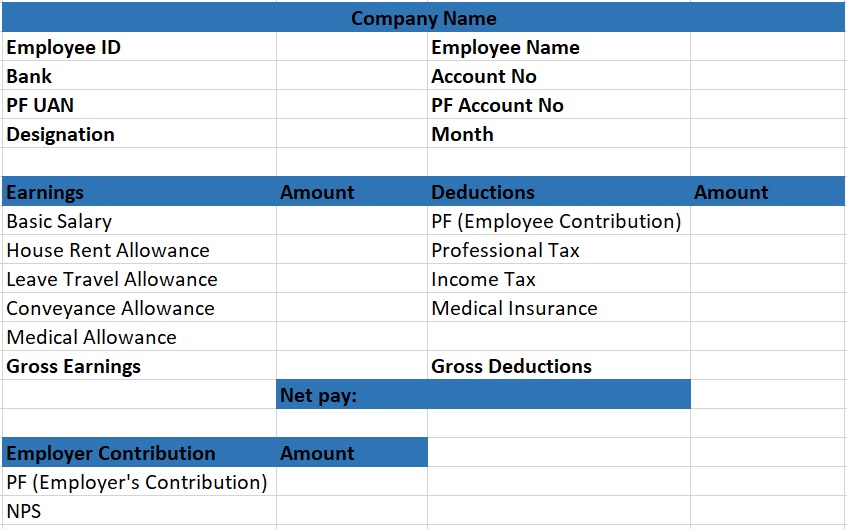

By understanding about salary slip, I mean understanding the components in our salary slip and how these components are calculated. Below is the structure and and the components present in a basic payslip. These components can vary from company to company.

As we can see, the payslip contains 2 types of information:

Employee details

Such as Employee name, ID, Designation, bank details in which the salary got credited, Provident Fund details for the employee, and the month for which the salary slip is published.

Salary details

This section shows the individual components of your salary depending on your CTC (cost-to-company) and other factors. Lets understand each of these components. We’ll see the taxation of each of these components later in tax calculation.

Earnings/Gross Earnings

This consists of all the components which are paid by your company, before taxes and other deductions. Below are the components which are included in earnings:

- Basic Salary: As the name says, this is the basic part of your salary and is equal to 35-50% of your CTC. This component is paid to you before any deductions and extras such as HRA, Medical allowances etc. Some of the other components such as HRA, PF, NPS depend on this component. Basic Salary is fully taxable.

- House Rent Allowance: This component can be used by those employees who live in rented house, to lower their tax amount. If you stay in your own house, then this amount is fully taxable. This is equal to 40% of the basic salary if you reside in a non-metro city, and 50% if you reside in a metro city. More details on how much amount of the HRA can be used for claiming tax benefits on HRA can be found here.

- Leave Travel Allowance: This is the component which can be used by the employee to save tax on the travel cost for his leave. This component can be fully/partially taxable, depending on certain conditions described here.

- Conveyance Allowance: This is provided by the employer for the commute of the employee from home to office. It is also commonly known as transport allowance, and is fully taxable after the budget of 2018. If the company provides transportation for the employee, then this component is not provided.

- Medical Allowance: This is paid for the daily medical needs for the employee and his dependants, eg. medicines etc. This component has been declared fully taxable after the budget of 2018.

Deductions

This consists of all the components which will be deducted from your total earnings and the remaining amount is paid to you as a part of your salary. Deductions section consists of the following:

- Provident Fund (Employee’s contribution): Provident fund is a retirement saving which needs employees to contribute a part if their basic salary each month towards this fund. This amount is dependent on the basic salary and is equal to 12% of your basic salary (plus dearness allowance, if any), and is tax exempted under Section 80C. The employer is supposed to contribute the same amount to the employee’s fund (covered later in section Employer Contribution) and the government pays an interest on the total balance in your PF account every year.

- Professional Tax: This is a state tax and any salaried individual needs to pay this tax to the state government. The maximum professional tax which can be deducted per year is Rs 2,500. This component is tax free.

- Income Tax: This is an annual tax paid by the individuals or companies for any income/profits they make. In case of individuals, income tax is calculated based on the income slab rate. Higher the income of any individual, higher the tax rate will be for him. Honestly speaking, Income tax deserves a chapter on its own, so I’ll create a separate chapter for this and explain it in detail.

- Medical Insurance: Most of the companies companies provide medical insurance for their employees free of cost. However, if the employee wishes to opt for medical insurance for their dependants, they are charged an extra premium which is deducted from the salary. This can be fully/partially tax exempted.

Employer Contribution

There are some contributions made by the employer on behalf of the employee directly to the government fund/scheme, even before reaching the employee. These components are not a part of the employee’s salary and hence, are not taxed. However most of the employer count this as a part of your CTC (CTC is not the same as salary), when communicating the offer. So, next time you get your offer letter, keep in mind that your actual salary will be less than the actual communicated CTC.

Gross Salary = Cost to Company - Employer Contributions

Some types of Employer Contribution are:

- Provident Fund (Employer Contribution): This is the same amount as that of the Employee Contribution to the Provident Fund discussed above in ‘deductions’ section (12% of the basic salary).

- National Pension Scheme (NPS): This is another retirement scheme introduced by the Government for providing social security to the employees post retirement. After retirement, the individuals can take out a portion of the total value at the time of retirement as tax free lump sum amount, and rest as a form of monthly pension. You can read the complete details on NPS here.

Net pay: This is the total gross earnings minus the total deductions. This amount is the same which gets credited into your bank account. It is also commonly called as In-hand salary.

Net Salary = Gross Salary - Deductions

So, this was an attempt from my side to explain the components most commonly found in a salary slip. Please let me know through the comments below or Contact Me if you have any queries or your payslip has some component apart from the ones mentioned above, I’ll add it here.