After the 2001 dot com bubble, to normalize the flow of cash in the economy and to create liquidity in the market, the US Federal Reserve lowered the federal funds rate from 6% in 2001 to 1% in 2003. This brought the interest rates of housing loan to be negligible. Everyone wanted to wash their hands in money by purchasing a new home with a thought to sell it at profits later because apparently everyone thought ‘House prices will keep going upwards forever’. People started buying houses on loans and lenders started giving more and more loans, keeping the same house purchased with the loan money as a mortgage.

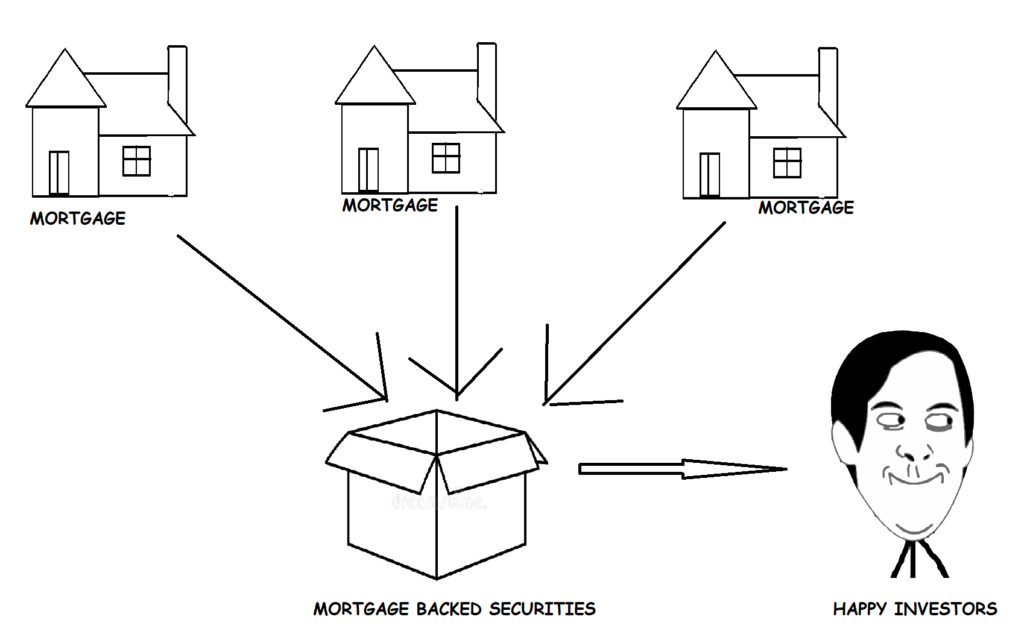

Lenders, to reduce their risks, sold these mortgages to investment banks. Since house prices kept on skyrocketing, buying a house was considered the best investment of the time. People were buying houses at any price, assuming “no matter when they sell, they will definitely earn good profits”. These investment banks bundled hundreds and thousands of mortgages together, and started selling instruments called Mortgage Backed Securities (MBS).

Since the underlying asset behind these Mortgage backed securities were houses whose prices were rising day by day, these securities performed better than any other investments. The top credit rating agencies gave AAA rating (highest possible rating) to these securities. The demand for mortgages increased, and now the supply started decreasing because the rate of giving new housing loans decreased (with background and credit check, not everyone can afford a house loan, right?)

To keep up with the supply, lenders came up with an idea of Subprime mortgages, which was basically a loan for the people with poor credit history and bad finances to buy their ‘dream house’. They started giving loans to anyone without a background check and without a stable income. Even 17 year olds who were earning minimum wages were getting house loans. The situation once was that anyone would walk into a bank and walk out with an approved house loan in their hand. There was one catch in these fancy-named ‘subprime mortgages’: The loan was structured in such a way that during the initial days the payment needed was less, but increased later.

With Subprime mortgages, the problem of reduced supply of mortgages was solved, and the lenders still had no risks since they transferred all their risks to the investment banks along with the mortgages.

So now, the risk of defaulting of loans was with the investment banks. To manage that risk, the investment banks bought Credit Default Swaps (CDS) from the insurance companies, which in simple terms was nothing but an insurance for their Mortgage backed Securities. This means that the insurance company would pay the investment banks in case the borrowers defaulted on their payments. The credit rating agencies were still giving these securities AAA rating based on past data.

So now, the status was:

- People were getting loans and buying houses which was increasing in value. No risk!!!

- Lenders were issuing new loans and selling them to investment banks at good price without the worry of borrowers defaulting on their loans. Even in the worst case, they could still sell the ever-appreciating in value houses and recover their money. No risk!!!

- Investment banks were loaded on ‘ever-increasing’ Mortgage backed securities. They also had no risk since they had ‘insurance’. No risk!!!

- The insurance companies were getting premium and they only had to pay the investment banks if the MBS reduced significantly in value. But apparently, since the house prices would never decrease, the MBS would never lose value and thus, they never have to pay the investment banks. No risk!!!

Sweet, no? Everyone was gaining, and none had any risks. Investment banks kept on borrowing more and more to create more of these Mortgage backed securities.

The public was made to believe that this product is the best for high returns without any risks. The then chairman of board and CEO of Countrywide Financial, one of the biggest lenders at that time had told to his senior executives in an email:

“In all my years in the business, I have never seen a more toxic product”

Things started getting ugly once the Federal reserve started increasing the interest rates. Few subprime borrowers started defaulting on their loans, followed by a large number of defaults, and it was increasing rapidly. This led to a decrease in the demand of house loans, whereas the supply was abundant. Decrease in demand and too much of supply led to rapid fall in the price of houses. The HOUSING BUBBLE had bursted. Even the borrowers who were able to pay their mortgages stopped paying because, why pay for a house whose value is much less than the loan? Since housing sector depreciated in value, the investors started taking out their money, and the values of Mortgage backed securities plummeted.

So what? The investment banks had insurance, right?

Yes, correct. The only problem was that the insurance companies had sold CDS whose due was much more than even their net worth, and were unable to pay the cover. So now, many of the investment banks who were managing not just the mortgages, but also individual retirement accounts, mutual funds and pension funds of the people, were on a verge of collapse.

From ‘No risk’, the situation suddenly became:

- People were unable to pay huge mortgages. They were losing their retirement funds.

- Banks could not sell the mortgages to investment banks and had to suffer losses. They couldn’t even sell the houses to recover their money because the loan which they gave was much more than the current price of the houses.

- Investment banks were in huge debts since they had borrowed nearly 30-40 times their cash in hand to create these securities. They could not get their cover money from insurance companies.

- The insurance companies were a lot in debt since they had issued insurance for a lot more than what they were capable of.

Whole of the US economy came down all of a sudden. Stock market crashed. The US index Dow Jones, which was once trading above 14,000 fell to less than 7,000 during this crisis (chart in the above image). Many big companies, including the 158 years old and the 4th largest investment bank of the US, Lehman Brothers, declared bankruptcy. Companies which were termed as ‘Too Big to Fail’ failed, and were either shut down, sold for pennies or had to be bailed out by the government. Millions of people lost their jobs along with years of their retirement savings.

Post the crisis, to stabilize the economy the government had to spend more than $700 Billions to bail out many companies like the insurance company AIG, Bank of America and may more.

A big lesson which can be learnt from the Financial crisis of 2008 is: Don’t keep all your investment within same industry or country. DIVERSIFY!!

A lot of movies and documentaries have been created highlighting some of the key events of the 2008 financial crisis, also known as the Subprime crisis. Some of my favourites are ‘The Big Short‘, ‘Too Big to Fail‘ and ‘Inside Job‘. Do watch them to know more on the crisis.

Liked the article? Let me know in the comments below or using the Contact me page.

Stay happy, keep investing!!! 🤑🤑🤑

Hi! I’m Gaurav, a Software Engineer by profession and a credit card enthusiast by heart. I love earning reward points and cashbacks from credit cards and giving ‘gyaan’ on credit cards and personal finance.