Standard Chartered DigiSmart Credit Card Review

Standard Chartered Bank recently launched the Digismart Credit Card solely focusing on the millennials in India. This card is very good for the people using Myntra, Yatra, Zomato, Ola, Grofers and Inox frequently since it provides good offers on these merchants.

Fees

Joining Fee

None

Monthly Fee

Rs 49 + GST (18%), waived off on spending more than Rs 5,000 in the previous month (as mentioned on their website). However, this is not actually waived off. Rather, it is credited to the card post 90 days of the month for which the spend exceeds Rs 5,000.

Eligibility for Standard Chartered DigiSmart Credit Card

- Age of the applicant: 21-65 years

- Good CIBIL Score (A score above 700 should be good to qualify)

- Stable income

Note: You cannot apply this card directly through the bank website if you hold any other credit card from Standard Chartered. You’ll need to contact the customer care for upgrade.

Benefits

This card provides exciting cashback/discounts for the merchant described above. The benefits for using this card with partner merchants are:

Myntra

- 20% instant discount (up to a maximum discount of Rs 700) on 1st transaction every month on Myntra website/app (No minimum transaction amount needed)

- This offer can be clubbed with any other ongoing offer on Myntra (Except Standard Chartered bank offers)

Yatra

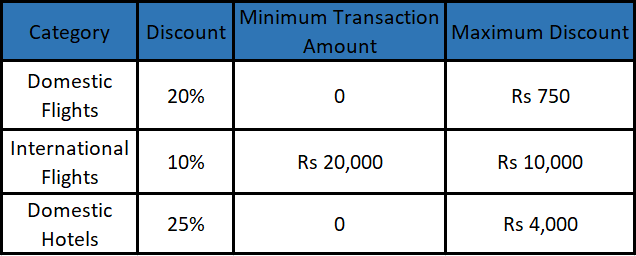

Digismart Credit Card users can avail discounts on domestic/international flight or domestic hotel bookings done on Yatra website/app when they do the payment using this card.

The above discounts can be availed only once per quarter for each of the mentioned categories. Also, the user will need to apply the coupon code ‘DIGISMART’ for availing the discount.

Ola

The card holders get 15% cashback, up to an amount of Rs 600 per month if they use their StanC DigiSmart Credit Card for payment on Ola app. However, note that only cab bookings are eligible for cashback, and not other ride types such as auto, bike and share. Also, Ola postpaid repayment and Ola money load transactions are not eligible for cashback.

Zomato

You can avail an instant discount of 10% (up to Rs 150 per transaction, with no minimum spend) for using your StanC DigiSmart Credit Card on Zomato app/website. This offer can be availed 5 times in a month on Zomato using the coupon code ‘DIGISMART’.

Note: You won’t be able to club this with any other ongoing offers on Zomato since they don’t allow multiple coupon codes in 1 single order.

Grofers

You get an instant discount of 10% (up to a total discount of Rs 10,000 per month) when you use your Standard Chartered DigiSmart Credit Card card on Grofers using the coupon code ‘DIGISMART’. There is no minimum order value required for availing the discount. However, you can use this offer a maximum of 5 times per month.

Inox

StanC DigiSmart Credit Card holders get Buy 1 Get 1 free offer on tickets purchased on Inox, for shows on Weekend. However, there is a weird condition with this offer that both the tickets need to be done on the same weekend. For instance, if you booked 1 ticket for Saturday, then you can book the second ticket for free on the same Saturday or the next day. This offer can be used twice per month.

Drawbacks

- Even though the card has decent cashback/discount rates for partner merchants, one major drawback of this card is that there you get ZERO benefits for using the card for non-partner merchants or for offline purchases.

- One more concern is that there is no complementary airport lounge access provided with this card.

- Although supplementary card can be issued for this card for the same fees per card (Rs 49 + GST), but the benefits provided are the same as those with only 1 primary card.

- High Forex Markup Fees: 3.5% + GST (18%)

Should you get this Card?

All the major categories: Apparel, Flights, Hotels, Cabs, Food, Grocery and Movies, have a merchant partner of this card. Given the low monthly fees and the waiver condition, this card is a must have if you are a frequent user of any of the partner merchants mentioned above. For instance, if you make just 1 purchase on Myntra worth just Rs 3,000 using this card, the annual fee will be recovered. I upgraded to this card from my lifetime free Platinum Rewards Credit card, and I consider this card to be a good decision.

You can apply for the Standard Chartered DigiSmart Credit Card directly through the Standard Chartered website (only for new users of Standard Chartered) or by contacting the Customer Care (for existing StanC Credit Card holders).

One very important point. If you get this card, don’t use it for any purchase other than the partner merchants since there are absolutely ZERO benefits for doing so. I’d suggest to get another card for offline swipes or non-partner purchases.

Let me know your thoughts or queries on StanC DigiSmart credit card in comments below. Want me to review any other cards? Let me know in comments below or using the Contact Me section of this website.

Hi! I’m Gaurav, a Software Engineer by profession and a credit card enthusiast by heart. I love earning reward points and cashbacks from credit cards and giving ‘gyaan’ on credit cards and personal finance.