In my previous post on Home Loans, I did a comparison of a 20 year and a 30 year home loans and explained how interest is calculated in a loan and the calculation involved while prepayment of the loan. We saw how prepayment helps in reducing the overall interest amount to be paid and closing the loan earlier than the actual tenure. But prepayment has its own set of disadvantages too. Let us understand the disadvantage of pre-paying a loan and how the SBI Maxgain loan account helps us overcome that problem.

In this post, I’ll be explaining the features a special type of home loan offered by the State Bank of India called SBI Maxgain Home Loan, and how we can use this effectively for maximizing the benefits while buying our dream house.

Disadvantage in prepayment of a home loan

In a normal home loan, the interest amount is calculated on a monthly basis on the average outstanding principal of that month. When we prepay a loan by paying an extra amount, the outstanding principal gets reduced by that amount, hence, reducing the interest amount for that month. Well, on one hand this is a good way to reduce your overall interest burden on the loan, but on the other hand there is a problem with this ‘prepayment’. You lose the liquidity of that extra amount which you have prepaid. If you need urgent money after prepayment, you would have to think of some other way to arrange for it.

Suppose you have a home loan with 20L principal remaining, and you got 10L as bonus from your employer. If you want to reduce your overall interest on the home loan, you can easily put that money into the loan account and reduce your principal amount by 10L, hence, reducing the interest component. But this comes at a cost. Say, you happen to need 10L for a medical emergency, you would have to arrange those 10L by some other sources. If there was a way you could take the prepaid amount back from the bank in such a case, wouldn’t that be awesome?

SBI Maxgain home loan works as a SuperLoan in such cases and can become a saviour. Let us see what this Maxgain Loan account is, how it works, and how you can exploit it fully while taking a home loan…..

What is SBI Maxgain Loan?

Well, SBI Maxgain is a Home loan product offered by the State Bank of India which is sanctioned as an ‘overdraft’ loan. The USP of this type of home loan is that it allows you to avail the benefit of prepayment without compromising with the liquidity. We can say it is the mixture of a loan and a normal savings account, as it offers you selected benefits from both the accounts. You get the loan to buy your dream home and pay it in EMIs, and you get a ATM/debit card and checkbook with this account just like a savings account. You can also transfer money to other accounts via NEFT, IMPS, RTGS, UPI using this account.

If you have acquired a good sum of money through your employer’s bonus or some other means, you can park the money in your SBI Maxgain loan account. By doing so, you would be reducing the outstanding balance on your home loan for the time this extra money stays in your account and hence, the total interest calculated for that time would be less. And in case you need the money later, you always have the option of taking that money out of the account. Once you take out the money, the interest calculation will go back to how it happens in normal case (the total outstanding principal amount).

In this account, the interest is calculated on the outstanding principal minus the extra amount lying in that account. Technically, this extra amount which you put in the account is not ‘prepayment’ since it does not reduce your outstanding principal, but it gives you the benefit of prepayment since you save the interest on this amount.

Sample Calculation

Here comes my favourite part: The maths. Well, let us see a sample calculation involved in the SBI Maxgain Loan. The calculation becomes a little complicated if you miss a tiny detail, so read carefully.

The cashflow in a loan account is as follows:

- The EMI amount is debited from your savings account and credited into your loan account.

- The outstanding principal of the loan is reduced by an amount of EMI minus the interest calculated for the previous month. In case of Maxgain Home Loan too, the outstanding principal reduced every month is the same as what it would be in the case of a normal loan.

- At the end of every month, the interest calculated for that particular month is debited from the loan account.

I have used the following for illustration:

Principal amount: 50L

Interest: 7.5% pa

Tenure: 20 years

With this specification of the loan, the EMI comes to be Rs 40,280. Also, let us assume that the borrower got a bonus of Rs 5L from his employer at the start of 2nd month which he kept in the loan account for 2 months and then took it out at the end of the 3rd month.

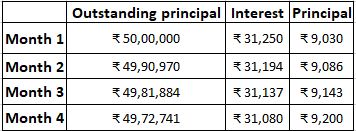

For a normal type of loan account, the credit and debit adds up. In month 1, Rs 9,030 is reduced from the outstanding principal, in second month Rs 9,086 and so on. Similarly, there will be an interest deduction of Rs 31,250 in the first month, Rs 31,194 in the second month and so on. The total amount debited every month (principal reduction + interest debit) will be the same as total amount credited in the loan account (EMI). In the above table, we can see it happening for the normal home loan (left table).

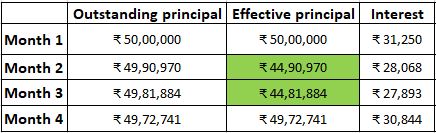

But, you might notice that this does not hold true for the Maxgain home loan. The principal reduced (Rs 9,030) + interest deducted (Rs 31,250) for the first month adds up to the EMI but for the second month (principal = Rs 9,086, interest = Rs 28,068), it does not. So where did the difference go? Actually the difference sits in the Loan account as a credit. So, in the example above, there will be an amount of Rs (40,280[EMI] – 9,086[Principle] – 28,068[interest]) = Rs 3,126 as a surplus amount in the loan account. You can withdraw it anytime you wish.

Suppose, you take a SBI Maxgain home loan of Rs 50L for 20 years and happen to receive a sum of Rs 50L through a lottery or by looting a bank. Well, you can put those 50L in your Home loan account and enjoy liquidity of up to 50L (depreciating every month) for those 20 years. Isn’t that great? 😎 Let me list out the advantages in a Maxgain Home Loan account.

Advantages of SBI Maxgain Home Loan Account

- Maxgain Loan account can help you leverage the benefits of prepayment while maintaining the liquidity of your extra money.

- Since you get a checkbook, ATM/Debit Card and can avail the benefits of NEFT, IMPS, RTGS and UPI, you can even use this account as your primary bank account.

- Money saved is money earned. If used wisely, your SBI Maxgain Loan account can be also be used as an investment. For example, if you want to invest in guaranteed income sources like Fixed Deposits, Public Provident Fund (PPF) or some Life Insurance plans (if we call them as investments 😆), you can park that money into the Maxgain Loan account and save on the interest amount and enjoy similar returns (savings actually).

- You can also use this account to set auto payments for your SIPs and other investments using mandate.

That said, the Maxgain Loan account has some drawbacks also.

Disadvantages of SBI Maxgain Home Loan Account

- The interest rate in the case of a Maxgain Home Loan is generally higher than a regular account. When I bought my first property in March 2017, I paid only 0.1% extra interest for my Maxgain Home loan than the interest rate in a regular home loan (8.55% vs 8.45%). Now this gap is increased to approx. 0.3-0.4% over the regular home loan.

- You might miss the potential high returns on the extra amount you put in the account, which you might get if you invest that in other investments like Mutual Funds, P2P Lending, National Pension Scheme etc.

- The benefits of Pradhan Mantri Awas Yojana Credit Linked Subsidy Scheme (PMAY CLSS) are not applicable on the SBI Maxgain Home Loan account even if you are eligible.

- If you are buying an under-construction property, then also you can park your extra surplus money in the loan account. However, till the time the construction is in progress, you cannot withdraw that money.

- YOu don’t get any interest on the extra amount even if that amount is more than the outstanding principal. For example, if you have a principal outstanding of Rs 20L and you park Rs 25L in the loan account, you will save interest on the 20L, but you won’t be earning any interest on the extra 5L you have put in the account.

Tax implications on SBI Maxgain Home Loan

The tax benefits given in the case of SBI Maxgain loan account is exactly the same as that of a normal home loan account. The actual principal amount paid by you will be exempted under the Section 80C of the Income Tax Act. The interest paid is exempted under the Section 24 and Section 80EE of the Income Tax Act. However, one important point to note here is that only the principal amount which is actually reduced in an year is eligible for tax deduction, and not the extra surplus amount which you park in the account.

Tips to exploit the SBI Maxgain Loan to the fullest

- Maximizing the loan amount: If you are planning to take a 40L loan for a 80L home and wish to pay remaining 40L from your savings, taking a Maxgain Loan of amount 60L and paying Rs 20L from your savings (and parking the remaining 20L into this account) might be beneficial for you, since you’ll get liquidity of that 20L and the interest paid on the effective balance (60L – 20L = 40L) will be the same. However, do note that the EMI would be higher in this case.

- Maximizing the tenure of your home loan: As explained in my previous post on ideal home loan tenure, financially it nearly always makes sense to go for the highest possible tenure Home Loan. In case of SBI Maxgain Loan also, if you go for a higher tenure home loan, you can enjoy liquidity of your money for a longer time.

Summary

Well, to summarize, the SBI Maxgain Home Loan is an excellent product offered by the State Bank of India which makes it stand out of the home loan market in India. This can be of great help if you have a surplus amount left with you at the end of every month. Also, by using the loan account as your storage account for extra funds, you can save much more than what you would get as interest in regular savings account. Availability of SBI Maxgain Loan was the major reason I went to SBI for getting a home loan, and not any other private banks. Recently, other banks like Axis Bank (Super Saver Home Loan) and Bank of Baroda (Home Loan Advantage) have also started providing overdraft Home loans, but they have their own set of limitations (like axis super saver has a maximum possible tenure of 20 years, with extra 2 years in case of an under construction home).

I hope you liked the article. If you have any questions related to the article, please let me know in the below comments. If you have any feedback or need any help in any topics related to finance, you can contact me using the Contact me section of this website.

To read more posts about personal finance and Credit Cards, please visit FinanceNerd blog page.

Stay Happy, keep investing!! 🤑🤑🤑

Hi! I’m Gaurav, a Software Engineer by profession and a credit card enthusiast by heart. I love earning reward points and cashbacks from credit cards and giving ‘gyaan’ on credit cards and personal finance.