Buying a home is the dream of most of the people. Due to sky-rocketing (or already sky-rocketed) prices of houses in most of the cities, it is becoming difficult for the middle class to buy a house just with savings. Home loan gives us the flexibility of buying our dream home now and paying back the money in affordable EMIs rather than paying all the amount at once, which most of us cannot afford. But the problem with home loans is that, the interest is compounded, and considering long term like 20 or 30 years, the interest paid can be significantly higher, sometimes even more than the principal.

Let us see some examples:

Suppose you take a loan of Rs 50L at an interest rate of 7.5% pa for 20 years, the EMI comes to about Rs 40,280. Hence, you pay a total of Rs 40,280 * 240 = Rs 96,67,200 over a period of 20 years.

If you take the same amount at the same interest rate of 7.5% for 30 years, the EMI comes to about Rs 34,961. The total amount paid in this case is Rs 34,961 * 360 = Rs 1,25,85,960 over a period of 30 years.

We see that the total amount paid in both the cases is considerably higher than the principal taken. It means, you are paying a huge amount as the interest against the loan you take to buy your dream house. Whether paying this much extra amount is worth it or not, I’ll cover in an other post. In this post, I’ll explain the best tenure you should opt for (financial view), while getting a home loan (same logic can be applied for other loans too, with a catch which I’ll explain in the coming sections). The calculations become little complex towards the later parts, so notice the numbers very carefully.

Calculation involved in Home Loan

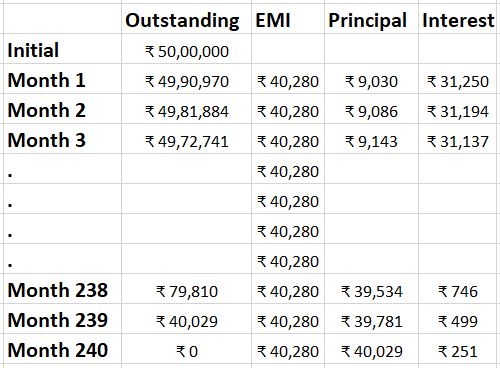

When you take a home loan, the interest for every month is calculated on the average outstanding balance of that month. So, the first month’s interest is calculated on the full principal amount. The loan is designed in such a way that the EMI is fixed every month. From that EMI, a portion goes towards the calculated interest for that month and remaining goes towards decreasing the outstanding principal. For example, see the table below for a home loan worth Rs 50L at an interest rate of 7.5% and a term of 20 years:

For the first month, the outstanding principal is 50L. Hence, the interest for the first month is: (7.5 / 12)% of Rs 50L = Rs 31,250. Out of the EMI amount paid by you (Rs 40,280), Rs 31,250 goes towards the interest for that month and the remaining amount (Rs 9,030) goes towards the principal. Hence the outstanding principal for the next month becomes Rs 50L – Rs 9,030 = Rs 49,90,970 and the next month’s interest becomes slightly less than the first one (7.5 / 12)% of Rs 49,90,970 = Rs 31,194. Since the outstanding principal keeps on decreasing every month, the interest keeps on decreasing every month.

Comparison of a 20 year home loan and a 30 year home loan

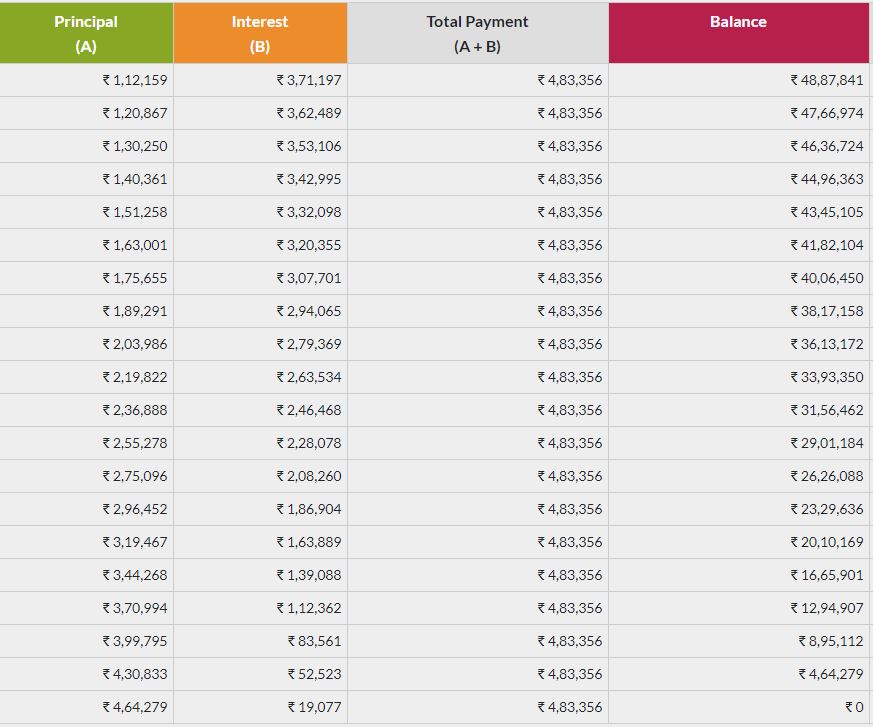

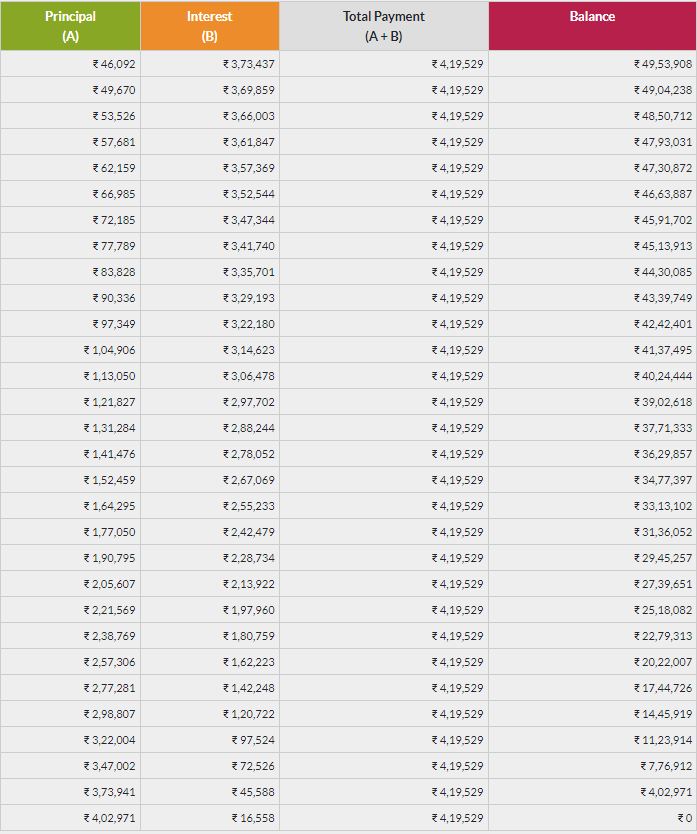

Let us see the year wise principal and interest break-up for a 20 year and a 30 year loan. In both the cases, I have used the following for illustration:

Principal amount: 50L

Interest: 7.5% pa

In the example mentioned above, the EMI is comparatively higher but the total amount paid in the case of a 20 year loan is much less than that of a 30 year loan (Rs 96,67,200 vs 1,25,85,960). Similarly, if we take a 10 year loan, it will be even lesser.

Does this mean that going for a less tenured loan is better than a high tenured loan? Before I answer this, let us see another table.

Noticed something interesting? Even though the principal amount paid every month is less than the principal amount paid in a 20-year loan, the interest amount paid every year is same as that in a 20 year loan (there is difference of few rupees in some of the rows because of rounding). How did it happen?

This happens because of something called as prepayment. You must have noticed another column ‘Prepayment’ next to the ‘Principal’ column. Let me explain what that is……

Prepayment

Most of the home loans offer you prepayment facility, which means you can pay some extra amount as a repayment of the loan, apart from the regular EMI. This extra amount you pay goes completely towards the principal. So, in the 20 year loan (first image above), suppose you pay Rs 20,000 extra at the beginning of the second month as a prepayment (apart from the regular EMI of Rs 34,961), your outstanding principal amount in the second month becomes Rs 49,72,555 instead of Rs 49,92,555. Hence, the interest calculated for the second month becomes a little less than what it should have been (without prepayment).

You might be wondering, how did I come across the prepayment value of Rs 63,828? It is nothing but the annual difference between the EMIs of 20 year and 30 year loans (Rs 5319 * 12 months). One thing to notice here is that, even though I took the loan for 30 years and pre paid the amount equal to the EMI difference between 20 and 30 years loans, the outstanding balance became exactly Zero in 20 years because of prepayment.

You might think: Okay, what is the use of going through all this hassle if we have to close the loan in 20 years?

The biggest benefit which I see in opting for a loan of 30 years (and pre paying the EMI difference) over simply opting for a loan of 20 years is that your monthly ‘liability‘ is less in case of a 30 years loan when compared to the monthly liability in the case of a 20 years loan. Even though you pay the same money (EMI + prepayment amount) in both the cases, you have the flexibility of paying less if you want (or need). In case you lose your job and have cash crunch for a few months, you only have to think of arranging Rs 34,961 and not Rs 40,280. You’ll have the flexibility to invest in other properties, or you can invest the difference amount in other instruments like mutual funds etc, which might be able to give you a better return over long term as compared to the interest you pay on that amount.

You can go to the below links and try out the calculations yourselves.

Normal Calculator

Calculator with prepayment

Bottomline

Okay, so a 30 year loan is always better than a 20 year loan? The answer is: it depends. There are few scenarios which you need to keep in mind while opting for a loan with prepayment:

- Some banks may charge you prepayment charges on the amount you prepay. Like, HDFC charges 2% of the amount you prepay during the first 6 months of your loan. So you need to consider that prepayment cost also while doing the calculations.

- Taking a 20 years loan might be an emotional advantage for some people in the sense that they might not be okay with the fact that they have taken a loan of 30 years, even if they would eventually be paying it off in complete by the end of 20 years.

Apart from these, I don’t see any other disadvantage in going for a 30 year home loan over a 20 year home loan. If you don’t have prepayment penalty (or small prepayment penalty), you SHOULD ALWAYS go for a longer term loan with prepayment rather than going for a shorter term loan. Also, combining a 30 year home loan along with SBI Maxgain Home Loan helps exploit your money even more. It gives you more liquidity and less liability (in case something bad happens). Be like the guy below

Did you like the article? If you have any questions related to the article, please let me know in the below comments. If you have any feedback or need any help in any topics related to finance, you can contact me using the Contact me section of this website.

To read more posts about personal finance and Credit Cards, please visit the blog section.

Stay Happy, keep investing!! 🤑🤑🤑

Hi! I’m Gaurav, a Software Engineer by profession and a credit card enthusiast by heart. I love earning reward points and cashbacks from credit cards and giving ‘gyaan’ on credit cards and personal finance.